As fall starts, coffee shops all around Fresno release their iconic fall menu. You find yourself craving a treat. Your feed shows people trying Starbuck’s new fall drink and sandwich. With your last 13 dollars, you decide to give in and try the new Starbucks menu. Could you have saved this money instead of spending it all on Starbucks? Was it worth it?

For the past few years, the spending habits of teens have increased each year faster than inflation. A study called “Taking Stock with Teens” shows the average teen in the U.S. spends more than $2,300 a year on food, clothes and social media.

When the average teen allowance is $1,500 a year, and only 33 percent of teens (ages 16-19) have a job, how can they create meaningful saving habits?

Fresno Christian Cross Country and Track and Field Coach Shawn Young has also worked for RB Capital Management for 20 years as an investment adviser and Chief Operating Officer.

“Money can be a huge stressor in life, so good stewardship of your resources can lead to a healthier life,” Young said.

The truth is, if teens don’t prioritize money management it can set them up for failure once they enter adulthood and start living independently. The average American debt for ages 18-23 is $9,500, but once people get into the 24-39 age group it rises to just under $80,000 according to CNBC.

Here are some helpful tips to save more money and create saving habits in your early life for success:

Clothing

Teenagers spend 21% percent of their money on clothing brands, according to “Piper Sandler Reports.” This amounts to $400-500 a year at minimum. Instead of buying clothes you can’t afford, it’s important to live within your means. A good rule is if your parents can’t afford it you can’t either.

Eating Out

Food is the second biggest expenditure for teens, accounting for 20% of their expenses. That’s another $400-500 spent on food instead of eating at home. According to an article by Home Run Inn, only a third of teens can cook. Not going out and instead making a meal for yourself not only cultivates your culinary skills but also saves you 20% of your money.

Drinks

Beverages are another big money pit students face. Our generation’s reliance on getting “a helpful boost” is stealing money from our savings.

FCS Senior Chloe Johnson highly values her trips to Starbucks, which cost more than $1,500 a year. For Johnson, Starbucks is an outlet.

“It’s one of the few things I spend money on,” Johnson said. “I don’t regret spending money on Starbucks because it is something that I love.”

Saving money shouldn’t mean living a life devoid of all fun, it means being conscientious about how much you can spend and making smart decisions. Johnson said later that she is starting to go there fewer times a week.

An article by Chadhurst Sharpe on Kids Money points out that the average teen already saves between $500-700 a year.

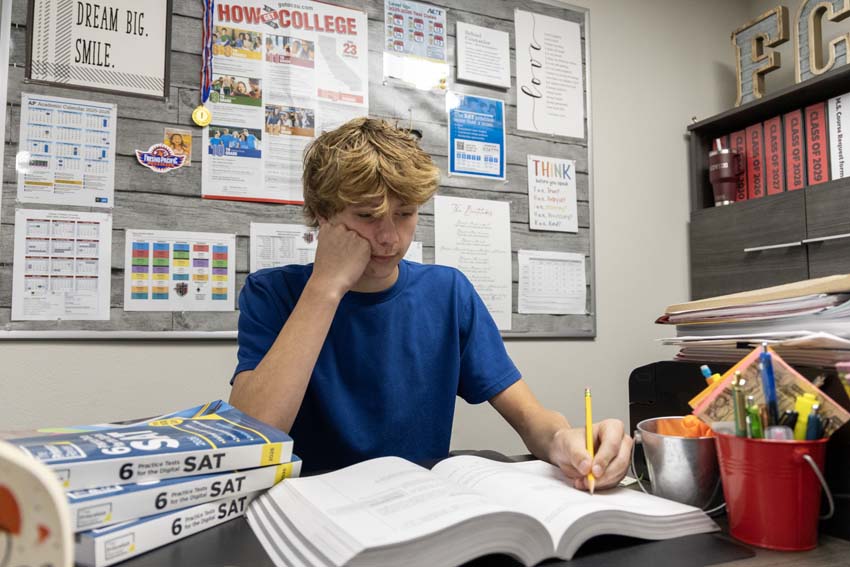

Garrett Reed, a junior at Fresno Christian, is doing his best to save money. He hopes to start his own landscaping money and talks about his daily expenses.

“My mom just helps me with my gas, that’s all,” Reed said. “So I’ve been saving for the other things in life and having a savings account for investing when I turn 18.”

Reed is a good example of a student who is trying to save. The problem is what to do with the money once it is saved. There are two ways you could go: save in an account or invest.

All teens should have a savings account. This is a bank account separate from your checking, which allows students to put money into a not easily accessible account. You’ll use it to keep your savings in one place so once you’re ready you can figure out the other steps.

The world of investing is another option, but it can also be intimidating for students. Here are five steps to educate yourself and set up an account:

How to get started as a student with investing

1. Find a mentor or influencer to follow

2. Create an investing account

3. Inform yourself and research the Market through Newsletters, articles, YouTube videos, and financial teachers

4 .Understand basic Market terms “like index funds, black swans, and mutual funds

5. Read financial guide books

To read more from The Feather, visit Veterans Day Chapel 2024 and Beloved soccer coach Sergio Venegas faces health challenges